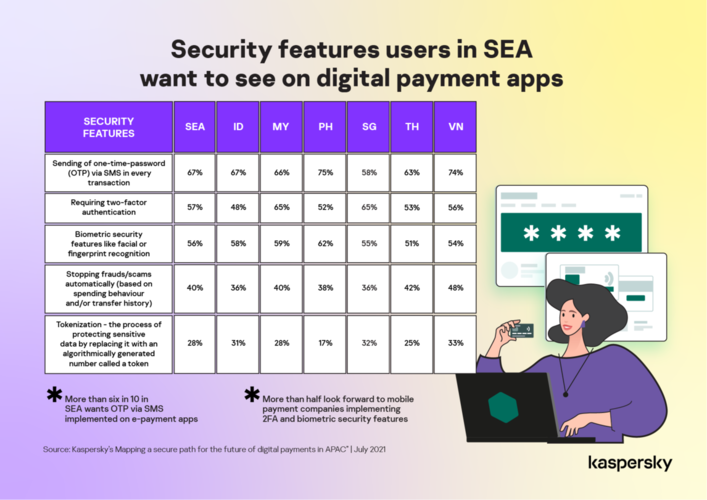

A recent study titled ‘Mapping a secure path for the future of digital payments in APAC’ by global cybersecurity company Kaspersky revealed that more than three in five (67%) users of digital banking and e-wallet apps in Southeast Asia (SEA) prefer the implementation of one-time-passwords (OTPs) through SMS for every transaction.

The study discovered that 57% of the respondents also want to see the implementation of two-factor authentication or 2FA, whilst 56% want biometric security features like facial or fingerprint recognition.

Yeo Siang Tiong, general manager for Southeast Asia at Kaspersky said payment companies should be assessed not just on their innovations but also on their security posture.

“We can draw from our findings that customers are increasingly becoming aware of the value of technology to protect their finances online. These security features are useful preventive measures that can potentially enhance the cybersecurity standards in the digital payments space. However, these options should not be viewed in an isolated manner but considered as part of a holistic cybersecurity framework,” he said.

The implementation of OTPs is the top priority for consumers in most SEA countries – including Indonesia (67%), Malaysia (66%), The Philippines (75%), Thailand (63%), and Vietnam (74%) – except Singapore where two-factor authentication is the most urgent concern (65%).

Digital payment customers also welcome the use of machine learning in combatting social engineering attacks. Almost half (40%) noted that companies should start preventing frauds/scams automatically based on spending behaviour and/or transfer history.

Over a quarter (28%) also said Tokenization – the process of protecting sensitive data by replacing it with an algorithmically generated number called a token – can also augment the security of mobile banking and e-payment applications in the region.

The usage of two-factor authentication, for example, has its limitations, particularly when it comes to SMS-based authentication.

Password-bearing SMS messages can be intercepted by a Trojan lying inside the smartphone, or by a defect in the SS7 protocol used to transmit the messages, making SMS-based 2FA unreliable at times.

In such cases, it would be advisable to employ self-contained authenticator apps, with SMS being used only as a last resort to limit a company’s vulnerability to data breaches.

With the complicated nature of securing apps and finances online, it is not surprising that over three in five (65%) of the respondents said that banks and mobile wallet companies should provide more incentives to maintain the security decorum – such as changing passwords regularly.

Another 60% noted that providers should educate users more about the threats online.

When it comes to choosing a mobile e-wallet provider, security remains a priority for digital payment users in SEA.

Yeo added that in order to develop a long-term and sustainable growth strategy, digital payment companies need to take into account some of the wants and needs of their users.

“While some of the preventive measures are not entirely new and have been around for some time, it is crucial to consider how security features can be integrated in a manner without compromising the user experience.

“Our study showed how customers are increasingly holding digital payment providers accountable to the security of their finances online so we suggest companies to determine the cybersecurity gaps in each of the stage of their payment process, and fit in the right IT measures in a calibrated manner,” said Yeo.

To stay protected from ever-changing fraud and cybercrime techniques, Kaspersky recommends digital payment providers to adopt the following measures:

- Ensuring prompt patching and updating of software to prevent adversaries penetrating the system.

- Implementing high-grade encryption for sensitive data and enforcing strong credentials and multi-factor authentication.

- Using effective endpoint protection with threat detection and response capabilities to block access attempts, and managed protection services for efficient attack investigation and expert response.

- Educate your customers and employees on possible tricks malefactors may use. To save time and receive a quality service, companies should work with globally recognized providers that can ensure an efficient learning process.

- Conduct annual security audits and penetration tests to find security issues in a company’s network.

- Install a fraud prevention solution that can be quickly adapted for identifying new attack schemes and methods.

- For enterprises with mature IT infrastructure, install anti-APT and EDR solutions, enabling capabilities for advanced threat discovery and detection, investigation and timely remediation of incidents. Provide your SOC team with access to the latest threat intelligence and regularly up-skill them with professional training.