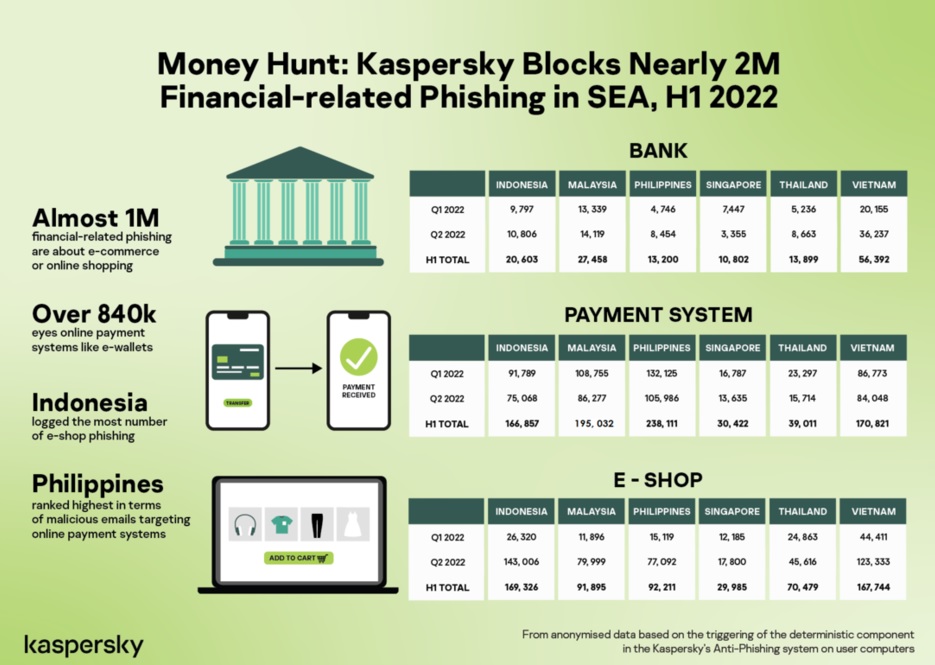

Global cybersecurity company Kaspersky detected in Malaysia a total of 195,032 payment system-related phishing activities in the first two quarters of 2022, with 108,755 in quarter one and 86,277 in quarter two.

The figure was the second highest among Southeast Asian countries after Philippines which ranked the highest with 238,111 in terms of malicious emails targeting online payment systems, Vietnam (3rd), Indonesia (4th), Thailand (5th) and Singapore (6th).

During the first six months of 2022, Kaspersky products also detected and blocked 27,458 bank-related phishing attacks and 91,895 of the same type targeting e-commerce shops in Malaysia.

Indonesia logged the most number of e-shop phishing with 169,326 detections, Vietnam (2nd), Philippines (3rd ), Malaysia (4th), Thailand (5th ) and Singapore (6th).

These data are from anonymized data based on the triggering of the deterministic component in the Kaspersky’s Anti-Phishing system on user computers.

The component detects all pages with phishing content that the user has tried to open by following a link in an e-mail message or on the web, as long as links to these pages are present in the Kaspersky database.

“The first half of the year witnessed the reopening of borders in Southeast Asia but the pandemic habits seem to remain consistent. Despite our regained physical freedom, we know that we still prefer to do our banking, shopping, and financial activities online because of its unparalleled convenience,” said Kaspersky Southeast Asia general manager Yeo Siang Tiong.

He said a total of 7.2 billion transactions were made with electronic payment channels in Malaysia in 2021, growing 30 per cent year-on-year, making it the fastest growing year since 2006.

“Driving cashless adoption will remain a part of an ongoing effort of the local government to bolster the domestic fintech industry.

“Regulators and industry players in the region are all backing a digital-forward Southeast Asia and Malaysia. In fact, countries here are poised to link their QR code payment systems before the year ends to remove currency exchange hassles.

“It is a welcome development with possible great economic gains, for us and the cybercriminals. With most users here aware of the threats targeting our online money, it is time to act now and secure your mobile devices to enjoy the perks of a more connected, regional financial environment,” added Yeo.

Kaspersky offers these steps below to avoid phishing scams:

- Always keep a keen eye on suspicious emails. If it looks too good to be true, check, double-check, and triple-check.

- Maintain two email addresses if you are using free accounts. One is for official use and the other is for websites that require you to log in to read the news or gather information.

- Not all smartphones are secure so be careful of messages that will lead you to a website. There are a number of malicious software that can gain entry into your contacts list and financial apps.

- Use a reliable security solution with anti-phishing and secure payment capabilities.

- Still, the best defense to phishing is being informed and discerning of the emails and other messages users receive.